What Okta’s Insight Into the Cloud Tells Us About Microsoft

In case you aren’t familiar with Okta, it front ends SaaS based applications with a single point of login. This is very similar to a Microsoft product called Azure Active Directory Premium, which has an App Panel for the same functionality. The one advantage that Okta has is that it likely has a more robust insight into cloud usage patterns as a whole and therefore can not only show Microsoft products, but a wide range of vendor solutions.

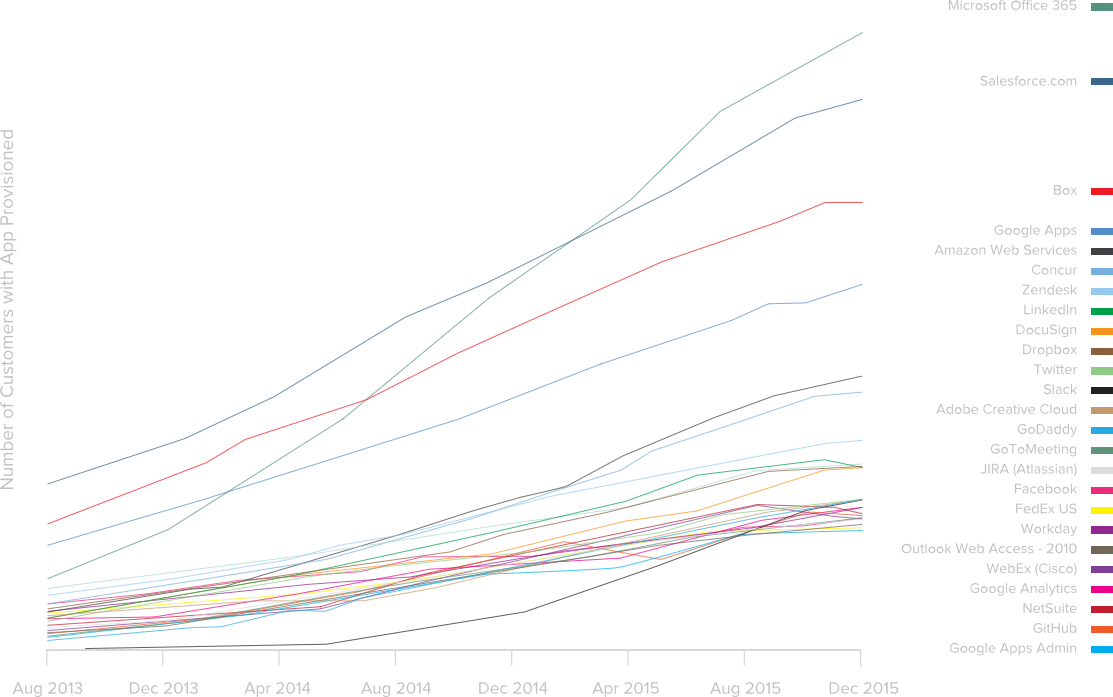

Fairly regularly, Okta will release a report on cloud usage and perform customer interviews to determine cloud usage patterns for Enterprises. The latest report was released and it shows good news for the Microsoft faithful. According to Okta, Office 365 is the most popular app they connect to.

https://www.okta.com/Businesses-At-Work/2016-03/

As you can see, Office 365 overtook Box in summer 2014 and then took the overall lead by surpassing SalesForce by early 2015. It doesn’t appear that another vendor will overtake Office 365 based on the trends. At Arraya, we’re not seeing nearly as many Exchange on-premises installs as Office 365 migrations anymore. It is rare, I’d say once a quarter, where a customer is looking for Exchange on-premises. The first real insight of this report is that the tipping point has definitely been reached.

What is most surprising is the number of Enterprise customers with Office 365 and Google Apps for Work. The most common reason given by companies for this is that different groups use different collaboration platforms. While this is a great thing about the cloud, it can cause IT headaches, especially from a management and security perspective. My personal feeling is that this will start changing and organizations will pick one or the other.

The most revealing fact is that 30% of companies subscribe to Office 365 because it is now the easiest way to license Office Pro Plus. Let’s think about what this really means.

There are a couple of reasons companies move to Google Apps, but the main reason I’ve seen is perceived cost savings. Google is $5 or $10/user/month while Microsoft has a range of options. Let’s not talk about why this is a bad way to look at this, since I’ve covered it before. Instead, what does this really show?

It appears to show that Google’s cloud productivity offering doesn’t match an Enterprise solution like Office, at least for 30% of the companies out there. While Google Apps for Work does come with an offline version of their cloud software (via Chrome) even this isn’t enough.

These companies are effectively running two productivity platforms and the corresponding infrastructure. With Office Pro Plus, there is a user tied to the license, which means they are likely synchronizing their Active Directory to both Google Apps and Office 365 (Azure Active Directory Basic).

Where did the savings go from going with Google Apps? You’ve just dashed your financials by NOT leveraging their productivity suite.

This is what makes Office 365 such a great sell. From top to bottom, it is an enterprise class solution. If you’re really considering Google Apps for Work, you need to be asking yourself if your culture can take less than what Office can offer or will you fall into the 30% that can’t?

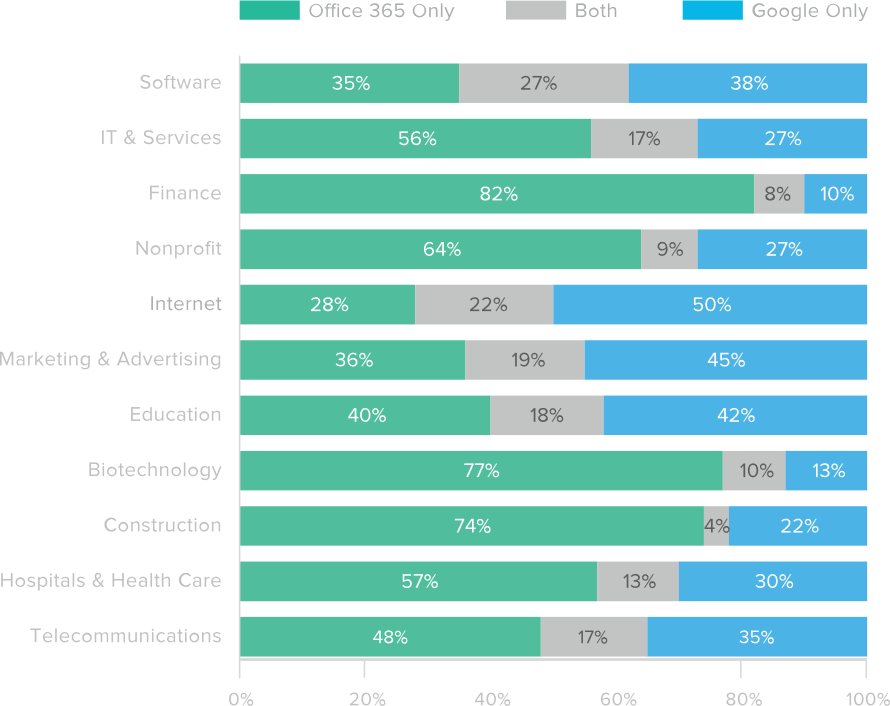

There’s one more set of statistics I’d like to discuss. The Office 365 and Google Apps usage by industry.

https://www.okta.com/Businesses-At-Work/2016-03/

What jumps out at me immediately is that Google doesn’t have the edge on Education that I thought they did. Clearly, Microsoft has made serious inroads here. The more interesting figure though is around Nonprofits.

Both Microsoft and Google offer free tiers for Nonprofits. For Microsoft, the free version does NOT include the Office software, but it is available at $2/user/month for up to 300 users. What amazes me here is that given the choice of free and a 1:1 comparison between Microsoft and Google, Nonprofits choose Office 365.

On another note, companies with potentially sensitive data, Finance, Biotechnology and Hospitals and Health Care are also choosing Office 365.

I encourage you to go read the full Okta report. It is a fascinating insight into the ongoing migration to the cloud. If there is one thing this report is screaming out, it’s that email has absolutely become a commodity service. It comes in as the number one app that is fronted by Okta. This shouldn’t be surprising to anyone paying attention to the cloud story. A lot of companies start here and add on other features later. As the cloud continues to evolve, it will be interesting to see what jumps out next!